Making great investments requires business acumen that only some people possess. A lot of people make good money from the stock markets — but only a few investors make a fortune. Only a few investors become legendary so much so that their strategies are followed by others. They become so influential that their decisions influence the market itself. But becoming a legendary investor is not easy. Learning investment requires focus, hard work, risk appetite and time. Today RiseMoneyWise pays tribute to some of the world’s greatest investors.

Let’s take a walk down the Hall of Legends!

1. Warren Buffet

There is no question that Warren Buffet is the most famous investor on the planet. His company Berkshire Hathaway and the man himself have become a source of folklore and inspiration for the new and accomplished investors alike.

The Oracle of Omaha, the Sage of Omaha, the Greatest Investor — Buffet is known by many nicknames. He was born on 30 August 1930 in Omaha, Nebraska, United States. He acquired Berkshire Hathaway, an erstwhile textile company, in 1965. Buffet then turned this enterprise into a holding company that today holds significant stakes in world’s biggest (and not so big) companies. In addition, Berkshire Hathaway wholly owns about 60 companies (including brands like Duracell, GEICO, Helzberg Diamonds etc.) The company has averaged an annual growth in book value of 19% to its shareholders since 1965. Berkshire Hathaway is among the world’s most valuable companies.

Buffet learned the art and science of investment from another legendary investor — Benjamin Graham.

2. Benjamin Graham

Benjamin Graham was born on 9 May 1894 in London, United Kingdom. He is credited as the inventor of the concept of value investing and, thus, popularly known as the Father of Value Investing.

Graham’s disciple, Warren Buffet later became the leading value investor. Graham was a professor of economics at the Columbia University. He published two of the most famous books on investment: Security Analysis (published in 1934) and The Intelligent Investor (published in 1949).

He also published the famous Benjamin Graham formula that calculates the valuation of growth stocks.

3. Bill Ackman

Born on 11 May 1966 in New York, United States, Bill Ackman follows the Activist Investor approach. His company Pershing Square Capital Management is a hedge fund management company. Ackman looks for good companies where he believes that a some changes could enhance the profit of the company. He then buys a substantial stake in the company. Ackman then uses his influence as shareholder to push the company to make the changes he desires. More often than not, Ackman’s intervention brings higher profits to the company. Once Ackman achieves the target value for the stock, he sells his stake.

4. Jack Bogle

Jack Bogle (May 8, 1929 – January 16, 2019) was the founder of the Vanguard Group. In 1976, Bogle created the First Index Investment Trust as the first index mutual fund available to the general public. Paul Samuelson, the first American Nobel Prize winner in Economics, ranked Bogle’s invention of index fund along with the invention of the wheel, the alphabet, Gutenberg printing. In the modern times, we all know what is a stock market index and our investment decisions are highly influences by these indices.

Jack Boggle is the writer of a bestselling classic book Common Sense on Mutual Funds: New Imperatives for the Intelligent Investor (published in 1999).

Bogle’s investment philosophy is based on simplicity and common sense. His eight basic rules for investors are:

- Select low-cost funds

- Consider carefully the added costs of advice

- Do not overrate past fund performance

- Use past performance to determine consistency and risk

- Beware of stars (as in, star mutual fund managers)

- Beware of asset size

- Don’t own too many funds

- Buy your fund portfolio – and hold it

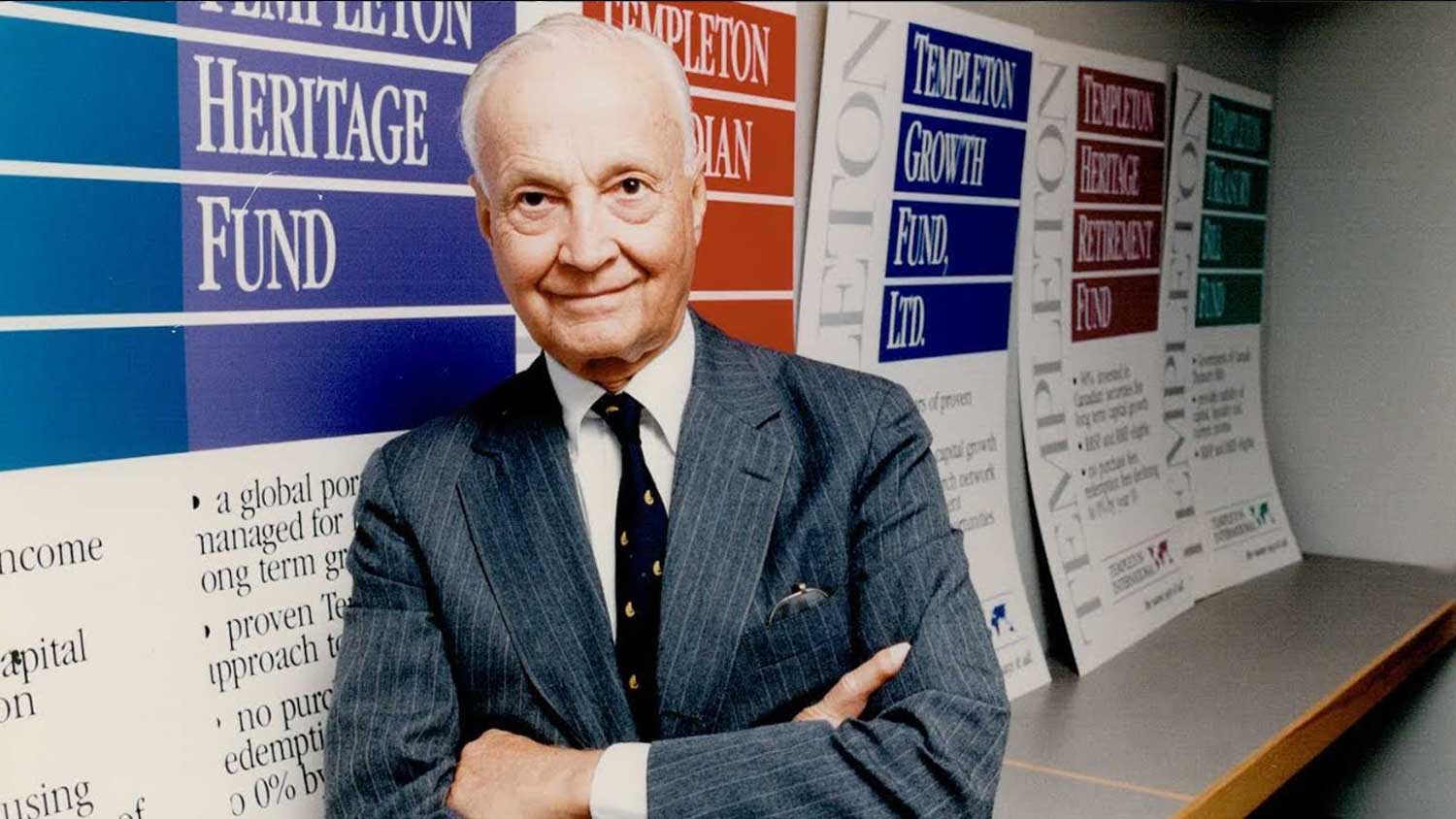

5. John Templeton

John Templeton (29 November 1912 – 8 July 2008) is probably the best known contrarian investor. He was the founder of Templeton Growth Fund, which averaged 15% growth for over 38 years! As an investment philosophy, Templeton followed the contrarian approach of “avoiding the herd” and “buy when there’s blood in the streets”.

During the Great Depression of 1930s, Templeton famously bought 100 shares of every company listed on the New York Stock Exchange that traded for less than one dollar. Later when the US economy picked during the World War II, Templeton’s bold bet paid off and he became a rich person.

This is not the complete list of world famous investors. We will keep adding more names to the articles. Who is your favorite investor? Whose investment approach you find most useful / interesting? Let us know!

Use the citation below to add this article to your bibliography

"The World’s Greatest Investors: Legends of the Stock Market." Risemoneywise.com. Web. June 6, 2025. <https://risemoneywise.com/greatest-investors/>

Risemoneywise.com, "The World’s Greatest Investors: Legends of the Stock Market." Accessed June 6, 2025. https://risemoneywise.com/greatest-investors/

"The World’s Greatest Investors: Legends of the Stock Market." (n.d.). Risemoneywise.com. Retrieved June 6, 2025 from https://risemoneywise.com/greatest-investors/